tax loss harvesting wash sale

The Dry-Cleaned Wash Sale. The asset sold is then replaced with a.

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

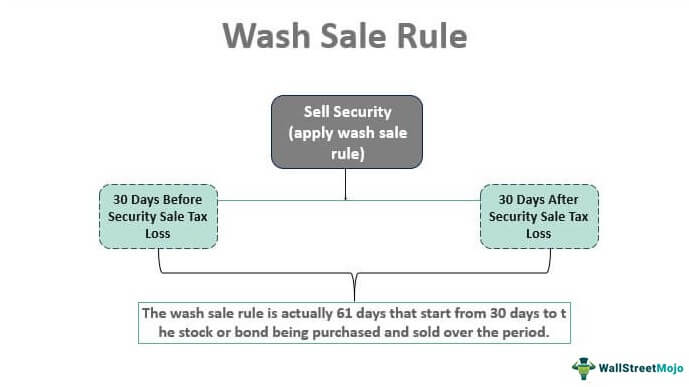

The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim artificial losses in order to maximize.

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

. And Mary would use the proceeds from the sale to purchase another fund to serve as a. Because your 800 loss is disallowed due to a wash sale the disallowed loss is then added to the price of your new shares to determine your cost basis for the new shares. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

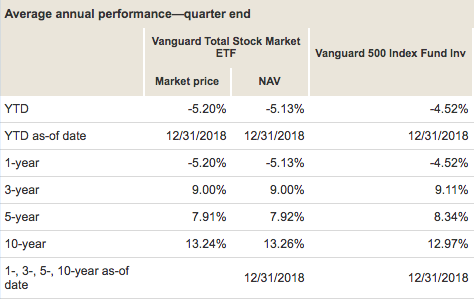

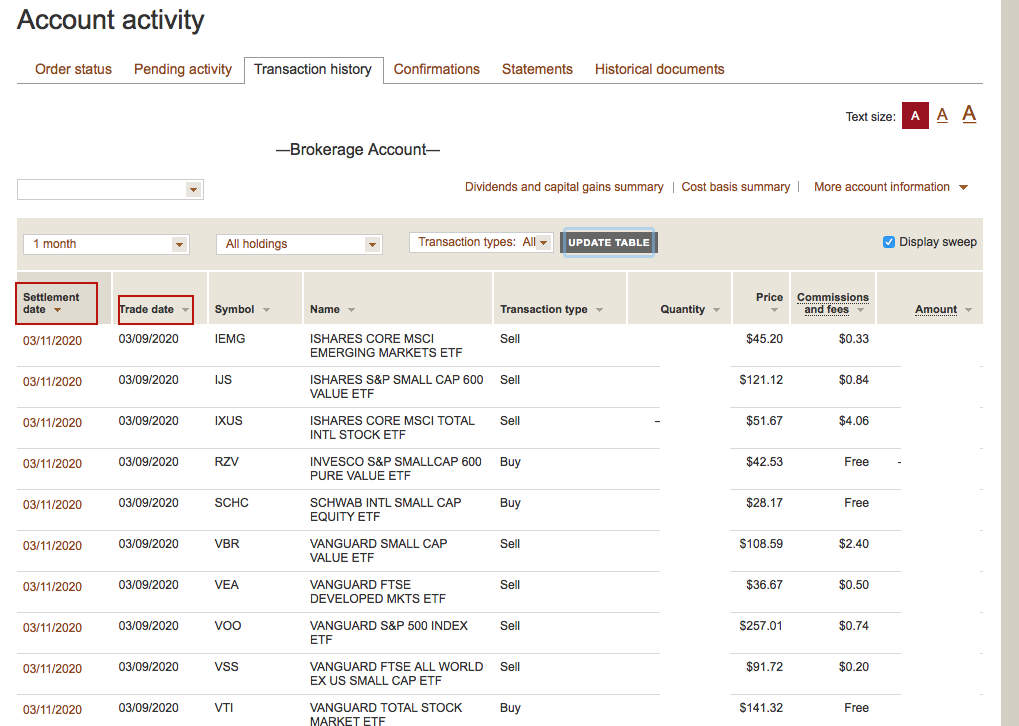

Wash sale rule considerations. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes. How to Avoid Violating Wash Sale.

Buy a cheap call. Without clear guidelines taking advantage of tax-loss harvesting with mutual funds could subject the taxpayer to back taxes interest and potential penalties should an IRS. Tax loss harvesting overview.

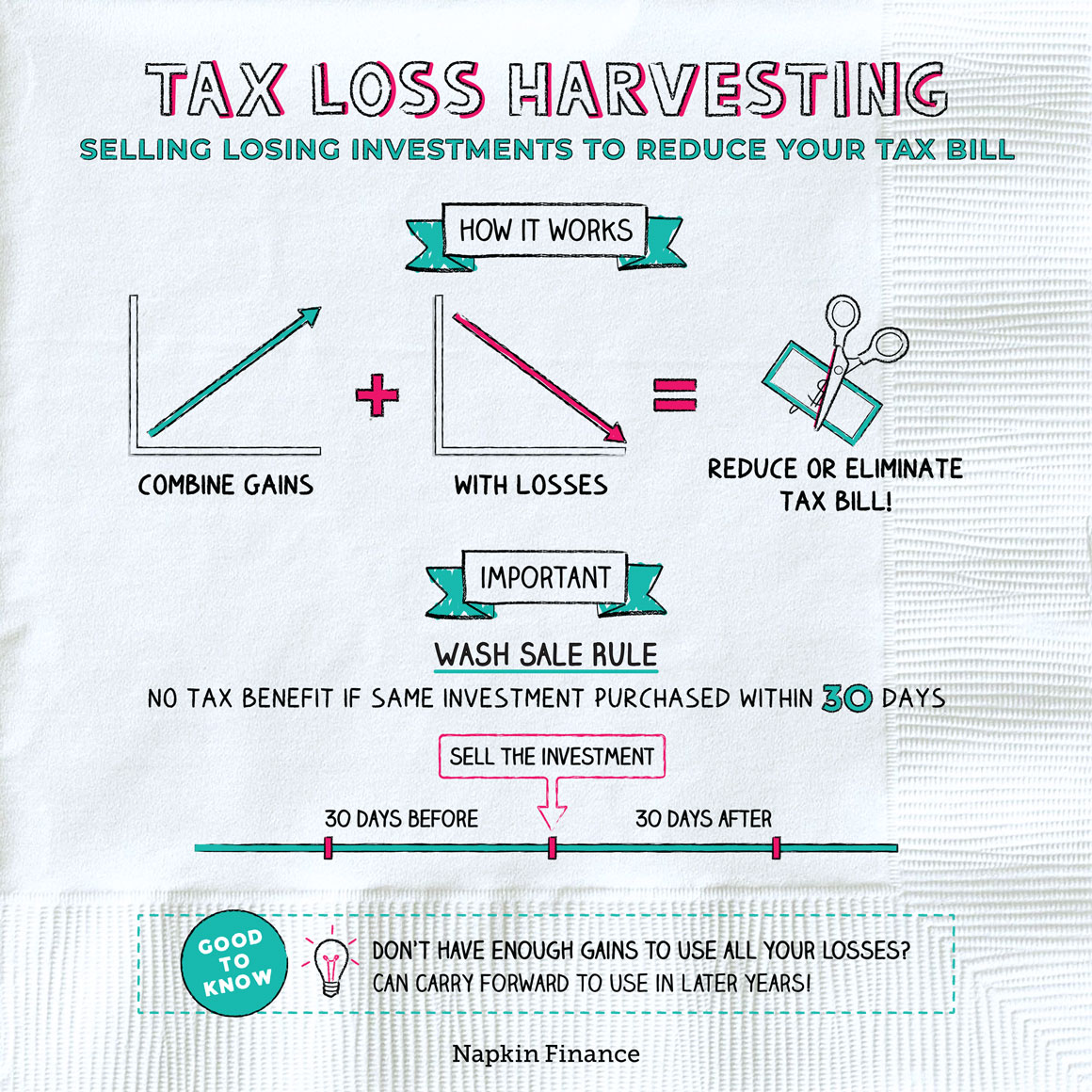

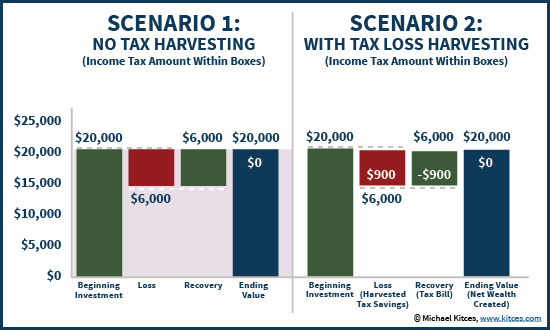

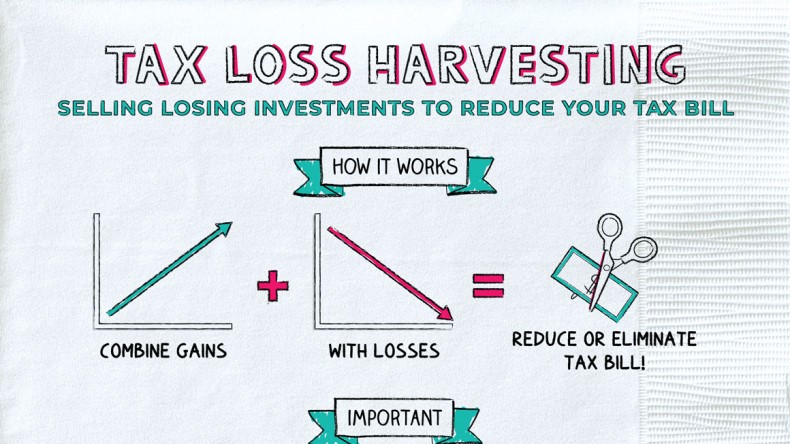

This can save a lot of tax. How the rule works. With tax-loss harvesting an investment that has an unrealized loss is sold allowing a credit against any realized gains that occurred in the portfolio.

Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction. Instead the disallowed loss increases the tax basis of the substantially identical securities. 800 767-8040 Free Consultations Nationwide.

To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. As most of you know gains on stocks are taxable but any losses reduce the net gain sometimes to even zero or less. Tax Loss Harvesting Limits Rules and Wash Sales.

You can achieve the same goal with a less expensive alternative approach. More specifically the wash-sale rule states that the tax loss will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical. Investors can offset up.

To claim a loss for tax purposes. The disallowed loss increases the tax basis of the substantially identical securities -- the Beta shares you acquire on 122121 -- to 20200 12200 cost 8000 disallowed. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income.

The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss. So far tax loss harvesting sounds like a great way to reduce ones tax liability.

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their. Tax Loss Harvesting and Wash Sale Rules. Tax-loss harvesting is the selling of securities at a loss in order to offset the amount of capital gains tax due on other investments.

If youre planning to sell stocksmutual funds at a loss to offset realized capital gains during the year its important to be aware of the wash sale rule. If an investment is not expected to perform well or to decline in the future then that investment is usually sold to. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder.

Unfortunately there are some limits and. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder.

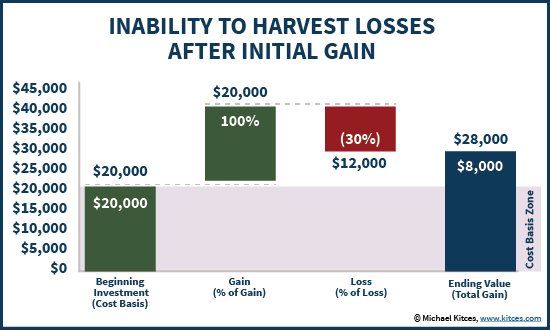

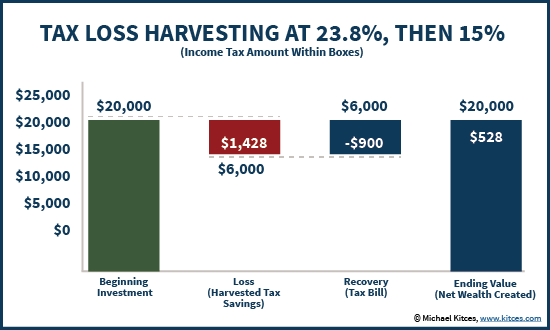

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wash Sale Rule Definition Example How It Works

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

How To Avoid Violating Wash Sale Rules When Realizing Tax Losses

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Flowchart Bogleheads Org

Tax Loss Harvesting Definition Example How It Works

Year Round Tax Loss Harvesting Benefits Onebite

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Wash Sale Rules

Tax Loss Harvesting Partners Physician Finance Basics

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital